Where can you find the most gyms in France? Who dominates the market and what are the strategies of the major brands?

Protéalpes analyzed France's 15 largest cities and their gyms.

Key facts:

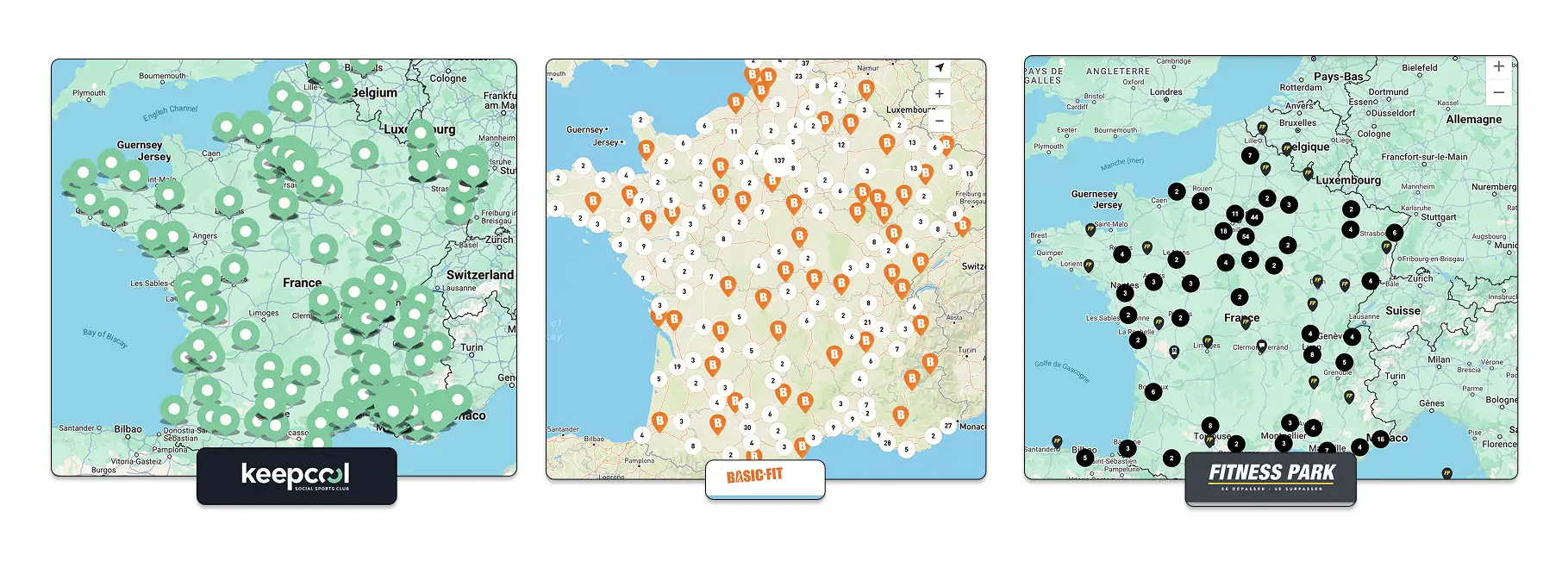

↳ Basic-Fit dominates with 899 gyms (48% of the market studied) in 665 towns

↳ The urban multi-location strategy makes the difference: 1.35 gyms per town on average

↳ Lille holds the density record with 9.64 gyms per 100,000 inhabitants

Our survey of France's 15 largest cities reveals a contrasting landscape, where city size does not necessarily guarantee better coverage of fitness facilities.

Among the major players, one brand in particular stands out. In less than two decades, Basic-Fit has pulled off a veritable tour de force: the Dutch low-cost fitness giant has established itself as the undisputed leader in France, completely reshaping the gym map.

Behind this domination lies a formidable implementation strategy that is forcing other chains to react.

Study methodology

This analysis covers France's 15 biggest cities by population, and examines the presence of 4 main gym chains:

- Basic-Fit (Dutch chain, leader in France),

- Fitness Park,

- Keep Cool,

- L'Orange Bleue (French chains).

Data reflect the presence of these chains in city centers and immediate suburbs.

Dominance through numbers

Basic-Fit has established itself as the major player in the French fitness market, with 899 of the 1,869 gyms analyzed (48.1%), representing almost half of the market studied.

This performance puts the Dutch retailer well ahead of its competitors:

- Orange Bleue (400 screens, 21.4%),

- Fitness Park (323 locations, 17.3%)

- and Keep Cool (247 locations, 13.2%).

This breakdown reveals a profoundly unbalanced French fitness market, where a single player has as much share as its three main competitors combined.

Geographical analysis shows that these 1,869 venues are spread across 1,455 towns and cities, proving that the market is no longer confined to metropolitan areas. However, the 15 regional capitals account for only one venue in eight, testifying to a strategy of territorial coverage based on proximity.

The multi-club strategy that makes all the difference

Basic-Fit is the only brand to exceed the threshold of one club per city on average (1.35 clubs/city), revealing a radically different approach to its competitors.

Where Orange Bleue favors wide geographic coverage with one club per town, Basic-Fit relies on the multiplication of outlets in densely populated areas.

This strategy of urban saturation is particularly true in large cities:

- Paris: 31 Basic-Fit gyms (more than half of the 56 total)

- Marseille: 25 theaters out of a total of 33

- Toulouse: 17 theaters out of 26

This approach enables the Dutch retailer to create a dense network that facilitates travel for its subscribers, while making it difficult for new competitors to set up shop.

| Sign | Positioning | Target areas | Business model | Average density | Forces | Weaknesses |

|---|---|---|---|---|---|---|

| Basic-Fit 899 rooms | Low-cost dominates | Metropolises Medium-sized towns | Owner Multi-location | 1.35 club/city | - Investment capacity - Extensive network - Aggressive pricing | - Standardization - Industrial image |

| Orange Bleue 400 rooms | Provincial proximity | Outlying France Medium-sized towns | Franchise Broad coverage | 0.85 club/city | - Territorial coverage - Local management - Little competition | - Limited investment capacity - Vulnerability to Basic-Fit |

| Fitness Park 323 rooms | Premium accessible | Commercial zones Urban peripheries | Owner Selective planting | 0.82 club/city | - Spacious facilities - Free parking - Additional services | - Slower growth - Direct competition with Basic-Fit |

| Keep Cool 247 locations | Urban-provincial balance | Inner cities Inner suburbs | Owner Selective approach | 0.78 club/city | - Differentiated positioning - Flexibility - User-friendly image | - Limited critical mass - Growing competitive pressure |

Lille, a laboratory for Basic-Fit success

Lille perfectly illustrates the effectiveness of this strategy, with 9.64 rooms per 100,000 inhabitants, the highest density in France.

This performance makes the northern metropolis a veritable laboratory for Basic-Fit's French conquest.

The top 5 best-equipped cities proportionally :

- Lille: 9.64 rooms/100,000 inhabitants

- Strasbourg: 7.53 rooms/100,000 inhabitants

- Bordeaux: 6.03 rooms/100,000 inhabitants

- Nice: 5.37 rooms/100,000 inhabitants

- Toulouse: 5.08 rooms/100,000 inhabitants

Conversely, some metropolitan areas are grossly under-equipped: Toulon (1.1 rooms/100,000 inhabitants), Saint-Étienne (2.3) and Le Havre (1.8) offer significant development opportunities.

How is the competition holding up?

Faced with this hegemony, the other chains have developed distinct strategies to circumvent it:

🔵 Orange Bleue: The provincial network strategy

Orange Bleue focuses on medium-sized and small towns, and is virtually absent from the 15 largest metropolises (only one gym in Nantes). This franchised model focuses on less competitive areas where Basic-Fit is not yet established.

With 400 gyms across the country, Orange Bleue has taken the bold step of avoiding direct confrontation with Basic-Fit in the major cities.

This French brand favors a franchised approach, enabling it to rapidly establish itself in medium-sized and small towns, where competition remains limited. Its virtual absence from the 15 largest cities reflects a deliberate strategy of circumvention.

Orange Bleue's business model is based on franchising, considerably reducing direct investment while accelerating territorial deployment. This approach enables local entrepreneurs to benefit from a national brand while retaining local management. Franchisees mainly target catchment areas of 20,000 to 50,000 inhabitants, creating a dense network in outlying France.

This strategy is showing its limits in the face of Basic-Fit's expansion, which is beginning to penetrate secondary markets. Orange Bleue is counting on its experience and in-depth knowledge of territories to resist, but its limited investment capacity in the face of the Dutch giant calls into question the long-term viability of this defensive positioning.

🟡 Fitness Park: The premium peri-urban approach

Fitness Park is concentrating its efforts on major cities, but with a peri-urban approach, favoring retail parks and shopping areas. Its lower density (0.82 clubs/city) reveals a more selective strategy.

Fitness Park is developing a distinctive strategy by focusing on shopping areas and retail parks on the outskirts of cities. With 323 gyms and a density of 0.82 clubs per city, the brand has opted for strategic locations in high-traffic areas rather than multiplying its outlets. This approach enables it to offer more spacious facilities with free parking, meeting the expectations of a motorized clientele.

Fitness Park's positioning is more premium than Basic-Fit, with recent equipment and generally larger spaces. The brand targets families and working people in suburban areas, often offering extended time slots and additional services such as childcare. Its notable presence in Paris (14 gyms), Toulouse (8) and Nice (7) shows its ability to compete with Basic-Fit in certain urban areas.

Strasbourg is a perfect illustration of this strategy, with 6 Fitness Park gyms compared with 5 Basic-Fit, making the Alsatian capital the only city where the French brand outstrips its Dutch competitor. This performance can be attributed to an early establishment and fine-tuning to local specificities, demonstrating that a differentiated strategy can still make a difference in the face of Basic-Fit's standardization.

🟢 Keep Cool: The French fitness balancing act

Keep Cool is developing an intermediate positioning with a balanced distribution between major cities and secondary markets, particularly visible in northern France.

Keep Cool occupies an intermediate position, with 247 gyms distributed more evenly between major cities and secondary markets. This French brand is developing a hybrid strategy, neither completely metropolitan like Basic-Fit, nor exclusively provincial like Orange Bleue. Its notable presence in northern France (4 gyms in Lille) reveals an ability to adapt to regional specificities while maintaining a significant urban presence.

The Keep Cool business model is characterized by a selective approach to locations, favoring profitability over maximum territorial coverage. The brand relies on medium-sized facilities in strategic locations, often in city centers or inner suburbs, targeting urban and suburban customers. This strategy enables it to maintain higher margins than the low-cost competition, while remaining affordable.

Keep Cool's resilience in the face of Basic-Fit's onslaught is explained by its ability to offer a differentiated service without tipping into the high-end. The brand cultivates an image of proximity and conviviality that contrasts with the industrial standardization of Basic-Fit, attracting a clientele seeking a compromise between affordability and a personalized experience. This balancing act could become a major asset if the market tires of standardization.

Initial investment: a considerable barrier to entry

Opening a gym represents a massive investment, which partly explains Basic-Fit's dominance. According to data from the Fédération Française des Métiers de la Forme, the initial investment for a fitness center varies between 300,000 and 800,000 euros, depending on size and equipment.

With its standardized model and purchasing volumes, Basic-Fit can optimize these costs while speeding up openings. This investment capacity represents a significant barrier to entry for newcomers, and explains why it is so difficult for French chains to compete.

Some grey areas in the conquest

Despite its dominance, Basic-Fit reveals geographical weaknesses. Strasbourg remains the only metropolis where Fitness Park is ahead of Basic-Fit (6 vs. 5 halls), suggesting that local competition can still make a difference in some areas.

What's more, the analysis reveals that Basic-Fit has not yet saturated the French market: with just 1 gym for every 74,527 inhabitants on average, the brand is still a long way from its density in its home country.

In the Netherlands, there are over 1,000 clubs for a population of just 17 million, i.e. 1 club for every 17,800 inhabitants. This Dutch density, 4 times greater than that of France, reveals enormous potential for growth in France.

Towards a recomposition of the market

This mapping reveals a French fitness market in the midst of radical change. Basic-Fit's volume strategy is redefining the codes of a traditionally more artisanal sector, forcing its competitors to specialize in niche markets.

The emergence of such a dominant leader calls into question the diversity of the French fitness offer. While Basic-Fit is democratizing access to sport thanks to its aggressive pricing, this concentration raises questions about the homogenization of the sporting experience and the survival of local players.

The figures paint a picture of an industry in transition, where economic efficiency now takes precedence over traditional proximity. Basic-Fit has not only conquered 48% of the French market: it has imposed a new model that is transforming the French fitness landscape for good.